Mozambique inflation

Inflation in Mozambique: An Overview

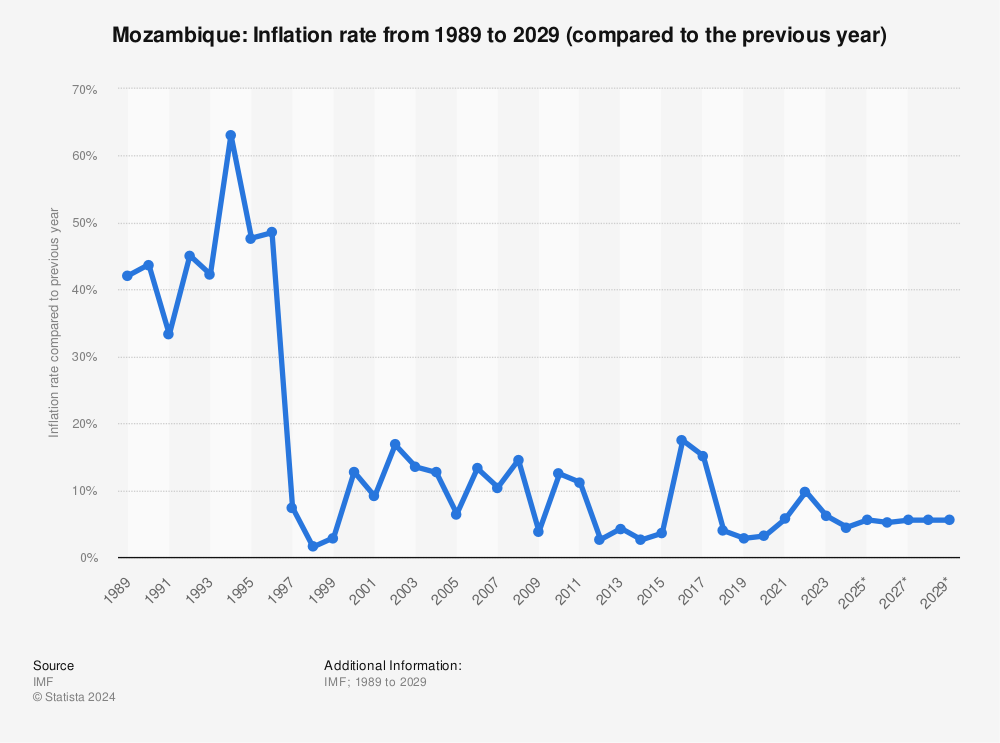

Inflation has been a significant economic concern for Mozambique, with recent trends suggesting a decline from 10.3% in 2022 to 3.2% in 2024, according to World Bank data. This analysis examines the various factors contributing to inflation in the country, including monetary and fiscal policies, supply chain issues, and consumer behavior.

Causes of Inflation

Monetary Policy

The Banco de Moçambique (BM) holds a pivotal role in influencing inflation through its monetary policy, particularly via the Mozambique Interbank Money Market (MIMO) rate. Since adopting an inflation-targeting framework in 2017, the BM has employed the MIMO rate as its main tool. As of January 2024, a high MIMO rate of 17.25% effectively curtailed inflation, which had previously surged following the economic strains of the early 1990s.

In a strategic move, the BM began to ease this policy in 2024, lowering the MIMO rate to 12.25% by February 2025 and reducing reserve requirements to stimulate credit growth. This adjustment reflects confidence in stable inflation. However, it does introduce the risk of renewed inflationary pressures if not managed prudently.

The impact of the exchange rate is also noteworthy. Mozambique operates under a floating exchange rate system, where past depreciation events have driven inflation by increasing import costs. A stable exchange rate in 2024, supported by prudent monetary policy, contributed to the observed decrease in inflation.

Fiscal Policy

Fiscal policy dynamics play a crucial role in influencing inflation levels. Historical large fiscal deficits fueled inflation spikes, as seen in 1990 when a deficit contributed to a 47% inflation rate. Recent efforts at fiscal consolidation have seen the deficit narrow from 5.1% of GDP in 2022 to 2.8% in 2023, helping to mitigate inflationary pressures.

However, in 2024, wage demands and interest payments consumed 92% of total tax revenues, straining available resources for public investment. Although these pressures limit demand-driven inflation, they place a strain on public services and overall economic activity.

The risk of excessive fiscal stimulus also looms large. While Mozambique's fiscal policy approach has targeted debt management to avoid inflationary spikes, the potential for contingent liabilities, particularly those linked to state-owned enterprises, poses further challenges ahead.

Supply Chain Issues

Mozambique's inflation is affected by both global and local supply chain dynamics. Events such as the COVID-19 pandemic and geopolitical tensions—including Russia's invasion of Ukraine—have disrupted supply chains, contributing to increased food and fuel prices and driving inflation to a peak of 10.3% in 2022. The country's reliance on agriculture makes it particularly susceptible to external shocks and climate events, such as droughts and floods, which can severely impact food supply and prices.

However, as of 2024, lower global oil and food prices, paired with improved local supply conditions, have contributed to the reduction in inflation to 3.2%. Yet, challenges persist, with ongoing global disruptions and climate shocks remaining significant risks to stability.

Consumer Behavior

Consumer behavior plays a fundamental role in the demand-side dynamics of inflation. In 2023, private consumption accounted for 5.0% of GDP growth. However, high inflation expectations stemming from historical inflation experiences, including a dramatic 163% rate in 1987, can lead consumers to accelerate spending, inadvertently fueling demand-pull inflation.

Inflation expectations are often volatile and influenced by past experiences, impacting consumption patterns and wage demands. While the BM's inflation-targeting framework aims to anchor these expectations, effective communication remains a challenge, limiting its efficacy.

During the pandemic, a notable shift toward durable goods increased demand, contributing to inflation pressures in 2021 and 2022. Nonetheless, limited financial inclusion, with only 40% of adults holding bank accounts, and high levels of underemployment—estimated at 80% in the informal sector—continue to curtail consumer spending and mitigate demand-driven inflation.

Summary

Inflation in Mozambique, currently standing at 3.2% in 2024, reveals the effectiveness of the Banco de Moçambique's monetary tightening, fiscal consolidation, and easing pressures from global supply chains. The high MIMO rates and a stable exchange rate have played crucial roles in curbing inflation, while associated fiscal discipline has helped to reduce demand pressures. Nonetheless, the nation faces ongoing challenges from supply chain disruptions and vulnerabilities linked to global economic shifts and local climatic conditions. To maintain low inflation rates, the BM should focus on anchoring inflationary expectations, monitoring supply chains closely, and balancing monetary easing with vigilance, all while ensuring that fiscal policies address debt and wage pressures without triggering demand-pull inflation. For further details, individuals can refer to resources such as www.bancomoc.mz or consult relevant World Bank reports.