Mozambique LNG projects in the Rovuma Basin

Key Projects:

-

Mozambique LNG (Area 1): Operated by TotalEnergies, designed for up to 43 mtpa. ENH holds a 15% stake.

-

Rovuma LNG (Area 4): Operated by ExxonMobil and Eni, with capacity of 18 mtpa. ENH holds a 10% stake.

-

Coral Sul FLNG: Operated by Eni, began production in 2022 as Mozambique's first offshore LNG project.

These projects, located in Cabo Delgado's Rovuma Basin, are among the largest natural gas developments in the world.

related pages:

Mozambique's LNG Projects in 2025: Overview

Locations, Stakeholders, and Status

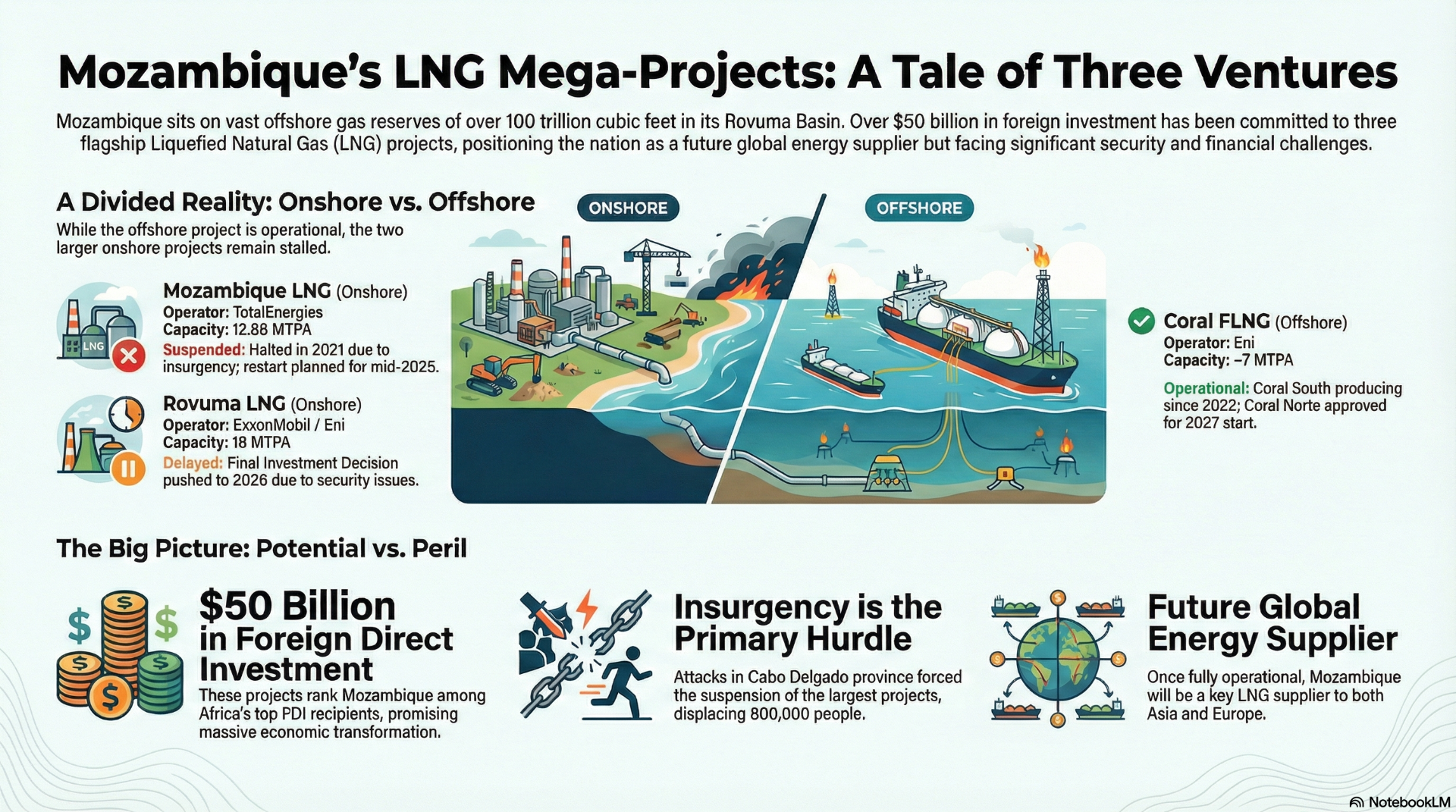

Mozambique is poised to become a major global supplier of liquefied natural gas (LNG), leveraging its vast offshore gas reserves in the Rovuma Basin to drive economic transformation. With an estimated 100 trillion cubic feet (tcf) of recoverable gas, the country hosts three flagship LNG projects: Mozambique LNG, Rovuma LNG, and Coral South/Norte FLNG. These projects, centered in Cabo Delgado province, have attracted over $50 billion in foreign direct investment (FDI), creating significant economic opportunities but also facing challenges from insurgency, financing delays, and socio-environmental concerns. This article provides an overview of the projects' locations, stakeholders, and status as of 2025, highlighting their role in positioning Mozambique as a key player in the global energy market.

Locations

All three LNG projects are located in the Rovuma Basin, offshore northern Mozambique, in Cabo Delgado province, a region rich in natural gas reserves but historically challenged by security issues.

Mozambique LNG (Area 1):

Location: The project develops the Golfinho-Atum gas fields in the Offshore Area 1 Block of the Rovuma Basin, approximately 40 km off the Cabo Delgado coast in 1,600-meter-deep waters. The onshore LNG facility is situated on the Afungi Peninsula, near Palma, with associated infrastructure including pipelines, storage tanks, and a marine terminal. The facility spans a 6,475-km² land use area (DUAT) shared with Rovuma LNG.

Significance: The Afungi Peninsula's proximity to gas fields and deep-water port capabilities makes it ideal for LNG processing and export to Asian and European markets.

Rovuma LNG (Area 4):

Location: Located in the Area 4 Block of the Rovuma Basin, 50 km offshore Cabo Delgado, the project targets the Mamba complex and other fields with 12 tcf of dry natural gas for initial production. Onshore facilities, including two liquefaction trains, are planned adjacent to Mozambique LNG on the Afungi Peninsula, utilizing shared infrastructure like the LNG marine terminal.

Significance: The site's integration with Area 1 facilities optimizes costs and supports large-scale LNG production.

Coral South/Norte FLNG (Area 4):

Location: These floating LNG (FLNG) platforms operate offshore in the Area 4 Block of the Rovuma Basin, approximately 80 km from the Cabo Delgado coast. Coral South is operational, while Coral Norte, approved in 2025, will be positioned nearby, leveraging existing maritime infrastructure.

Significance: The offshore FLNG model minimizes land-based disruptions, ideal for a region with security and environmental concerns.

Stakeholders

The LNG projects involve a mix of global energy majors, state-owned entities, and financial institutions, reflecting their scale and international significance.

Mozambique LNG (Area 1)

Operator: TotalEnergies EP Mozambique Area 1, Lda. (TEPMA1) holds a 26.5% stake and leads operations, having acquired the role from Anadarko Petroleum (now Occidental Petroleum) for $3.9 billion in 2019.

Partners:

ENH Rovuma Área Um (Mozambique state-owned): 15%

Mitsui E&P Mozambique Area 1 (Japan): 20%

ONGC Videsh (India): 10%

Beas Rovuma Energy Mozambique (India, ONGC-OIL JV): 10%

Bharat Petroresources Limited (BPRL, India): 10%

PTTEP Mozambique Area 1 (Thailand): 8.5%

Financiers: Secured $14.9 billion in project financing in 2020, including:

U.S. Export-Import Bank (EXIM): $4.7 billion loan re-approved in March 2025

African Development Bank (AfDB): $400 million

UK Export Finance (UKEF): $1.15 billion

Export credit agencies from Japan (NEXI), Netherlands (Atradius DSB), Italy (Sace), South Africa (ECIC), Thailand (EXIM Thailand)

19 commercial banks, including Société Générale

Contractors: Saipem (Italy), McDermott (U.S.), and Chiyoda Corporation (Japan) handle engineering, procurement, and construction (EPC) for the onshore LNG facility.

Rovuma LNG (Area 4)

Operator: Mozambique Rovuma Venture (MRV), a joint venture with 70% stake owned by:

ExxonMobil (U.S.): Leads onshore LNG construction and operations

Eni (Italy): Leads upstream facilities

China National Petroleum Corporation (CNPC, China)

Partners:

Galp (Portugal): 10%

Korea Gas Corporation (KOGAS, South Korea): 10%

Empresa Nacional de Hidrocarbonetos (ENH, Mozambique): 10%

Contractors: JGC (Japan), Fluor (U.S.), and TechnipFMC (UK-France) awarded the EPC contract for the onshore LNG complex in October 2019. Mitsubishi Heavy Industries (MHI) and Mitsubishi Hitachi Power Systems (MHPS) supply gas turbines and compressors.

Financiers: Financing details are less public, but the project is expected to secure loans from export credit agencies and commercial banks, similar to Mozambique LNG, with negotiations ongoing in 2025.

Coral South/Norte FLNG (Area 4)

Operator: Eni (Italy) leads operations, with a 25% stake in the Area 4 concession through MRV, alongside ExxonMobil and CNPC.

Partners:

Galp (Portugal): 10%

KOGAS (South Korea): 10%

ENH (Mozambique): 10%

ExxonMobil and CNPC: Share the remaining MRV stake

Financiers: Coral South secured $4.7 billion in financing from export credit agencies (e.g., SACE, Italy) and commercial banks in 2017. Coral Norte, approved in 2025, is expected to follow a similar model, with $7.2 billion in investments.

Contractors: TechnipFMC, Samsung Heavy Industries (South Korea), and Area 1 Concessionaires built Coral South's FLNG platform. Coral Norte's construction leverages similar expertise.

Status in 2025

The LNG projects vary in progress, with Coral South operational, Coral Norte advancing, and Mozambique LNG and Rovuma LNG facing delays due to security and financing challenges.

Mozambique LNG (Area 1)

Capacity: Planned for 12.88 million tonnes per annum (MTPA) with two liquefaction trains, expandable to 50 MTPA. Estimated 65 tcf of recoverable gas.

Status:

Suspended Since 2021: TotalEnergies declared force majeure in April 2021 due to Islamic State-linked insurgent attacks in Palma, Cabo Delgado, halting construction and withdrawing personnel from the Afungi site. The attacks killed dozens and displaced 800,000 people.

Progress in 2025: Security has improved with support from Rwandan forces and SADC Mission in Mozambique (SAMIM), enabling 570,000 displaced persons to return by 2023. TotalEnergies plans to restart construction by mid-2025, pending:

Financing Confirmation: The $4.7 billion EXIM loan was re-approved in March 2025, but loans from UK, Dutch, and other export credit agencies are still under review.

Security Stabilization: TotalEnergies requires "normal life" and public services to resume, with ongoing concerns after 2024 election-related unrest killed over 350 people and disrupted ports.

Cost Negotiations: Contractors seek a 20% cost increase due to delays, complicating financing. A human rights report by Jean-Christophe Ruffin (2024) raised issues about community resettlement and military ties, prompting TotalEnergies to address socio-economic concerns.

Timeline: Production, initially planned for 2024, is now delayed beyond 2029, with 2030 as a likely start date if construction resumes in 2025.

Challenges: Security risks, financing delays, and environmental criticism from NGOs like Friends of the Earth, citing Scope 3 emissions and human rights violations, pose hurdles.

Rovuma LNG (Area 4)

Capacity: Planned for 18 MTPA with two liquefaction trains (7.6 MTPA each), producing from 12 tcf of gas in the Mamba complex, expandable to 50 MTPA. Will supply 17,000 tonnes of LPG annually to local communities.

Status:

Development Phase: The project entered the front-end engineering design (FEED) phase in August 2024, expected to last 16 months. The final investment decision (FID), initially targeted for 2025, is now delayed to 2026 due to ongoing force majeure and security concerns in Cabo Delgado.

Progress: The Mozambican government approved the phase one development plan in May 2019, and an EPC contract was awarded to JGC, Fluor, and TechnipFMC in October 2019. ExxonMobil and Eni are advancing redesigns for modular electric LNG to enhance efficiency and reduce emissions. Production is targeted for 2030.

Security and Financing: While security improvements allow planning, the project awaits stabilized conditions and financing commitments, with negotiations ongoing with export credit agencies and banks.

Challenges: Delays in FID, security risks, and potential cost escalations due to global inflation (higher than 2019 estimates) could push production beyond 2030. NGO concerns about environmental impacts and community displacement also persist.

Coral South/Norte FLNG (Area 4)

Capacity:

Coral South: 3.4 MTPA, operational since 2022, producing LNG for export to Europe.

Coral Norte: Approved for 3.55 MTPA, with a $7.2 billion investment, expected to start production by 2027.

Status:

Coral South: Fully operational since November 2022, exporting LNG to Europe, marking Mozambique's entry as an LNG producer. The FLNG platform, built by Samsung Heavy Industries, operates offshore, minimizing land-based risks.

Coral Norte: The Mozambican government approved the development plan on April 9, 2025, paving the way for FID in 2025. The project builds on Coral South's success, leveraging existing infrastructure and expertise. Construction is expected to create 2,000 jobs and enhance local energy access with LPG supply.

Challenges: While less affected by onshore security issues, Coral Norte faces financing risks and environmental scrutiny over greenhouse gas emissions. The project's offshore model mitigates some community displacement concerns.

Regional and Global Significance

Mozambique's LNG projects are transformative for its economy and the global energy market:

Economic Impact: Expected to generate $10 billion in government revenue annually by 2030, reduce poverty (70% rural), and create 50,000 jobs. The projects have already attracted $50 billion in FDI, ranking Mozambique among Africa's top FDI recipients.

Regional Role: Enhances energy security for SADC neighbors via LPG supply and strengthens trade corridors, with Nacala supporting Malawi and Zambia under the 2023 Tripartite Agreement.

Global Role: Positions Mozambique to meet rising LNG demand in Asia (China, India, South Korea) and Europe (UK, Netherlands), diversifying supply amid geopolitical shifts (e.g., Russia-Ukraine).

summary

Mozambique's LNG projects in the Rovuma Basin, centered in Cabo Delgado, represent a cornerstone of its economic ambitions, with Mozambique LNG, Rovuma LNG, and Coral South/Norte FLNG poised to deliver over 34 MTPA by 2030. TotalEnergies, ExxonMobil, Eni, and partners like Mitsui, CNPC, and ENH, backed by $20 billion in financing, drive these initiatives, though Mozambique LNG and Rovuma LNG face delays beyond 2029 and 2030, respectively, due to security and financing hurdles. Coral South is operational, and Coral Norte is on track for 2027, signaling progress. Despite challenges—2024 unrest, infrastructure gaps, and environmental concerns—the projects' $50 billion FDI and job creation underscore their transformative potential. With stabilized security and financing, Mozambique can cement its role as a global LNG leader, driving regional integration and economic growth.