Business structures available in Mozambique

Choosing the right Business Structure for you

Navigating the Legal and Corporate Landscape: Choosing Your Entity

The selection of an appropriate legal structure is a foundational decision for any business in Mozambique. The new Commercial Code of 2022 has modernized the options available, providing greater flexibility and aligning the legal framework with international norms

The Commercial Code (Articles 1-330 for companies) outlines several entity types. The most common for startups and foreign investors is the Limited Liability Quota Company (Sociedade por Quotas - LDA), suitable for small to medium enterprises. Foreign branches or representative offices are options for non-incorporated presence.

The choice of legal entity must be carefully considered based on the scale of operations, liability concerns, and capital requirements. While some sources suggest a company can be started with "zero-share capital," and that there is no legally stipulated minimum capital , it is important to understand the practical implications. The registration process itself requires the payment of fees that are often calculated as a percentage of the declared share capital. Moreover, opening a mandatory bank account requires an initial deposit. Therefore, while the legal barrier to entry is exceptionally low, a nominal capital amount is still a practical necessity for the initial procedural steps.

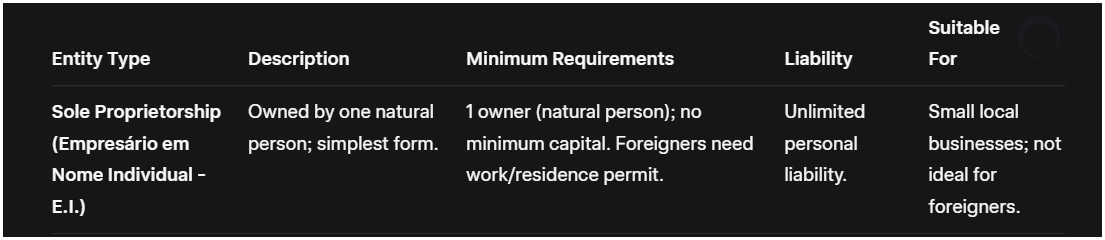

Sole Proprietorship (Empresário em Nome Individual - E.I.)

Sole Proprietorship (Empresário em Nome Individual): This is the simplest and most straightforward business structure, ideal for individuals operating a small-scale business. The process for registration is less complex, requiring only a visit to a One Stop Shop (BAU) office with personal identification and a Tax Identification Number (NUIT). The primary drawback of this structure is the absence of a separate legal entity, meaning the proprietor has unlimited personal liability for all business assets and debts

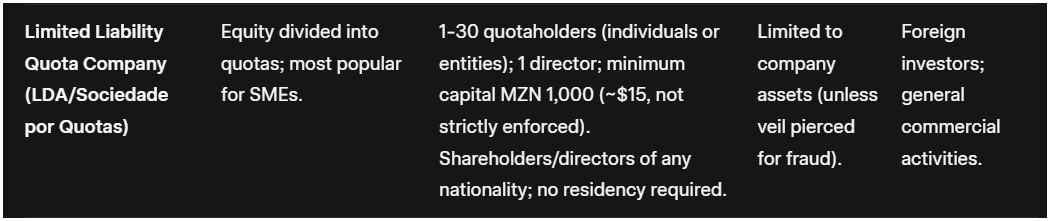

Limited Liability Quota Company (LDA/Sociedade por Quotas)

Private Limited Company (Sociedade por Quotas - LDA): The LDA remains the most common and popular choice for both local and foreign investors. This structure is characterized by the limited liability of its members, where responsibility for company obligations is restricted to the company's assets, and creditors cannot claim directly from the partners' personal assets. The new Commercial Code allows for a minimum of one shareholder for an LDA and has updated rules regarding the General Assembly and the transfer of quotas, offering greater procedural clarity.

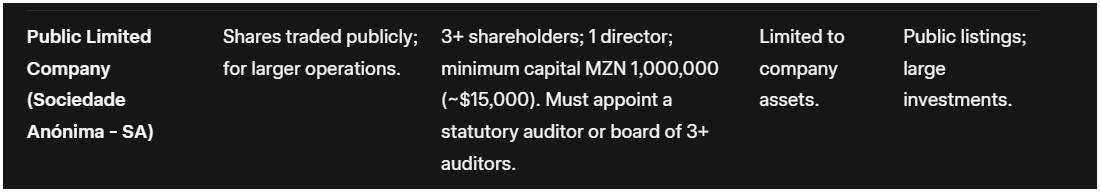

Public Limited Company (Sociedade Anónima - SA)

Joint Stock Company (Sociedade Anónima - SA): The SA is a more complex corporate structure, typically reserved for larger-scale ventures or companies that intend to raise capital through public subscription. Shares are always nominative, meaning the owners must be registered, and they are considered securities that must be registered with the Central Securities Depository (CVM). This structure requires a minimum of three shareholders and a more complex corporate governance framework, including a board of directors and a supervisory board or single auditor.

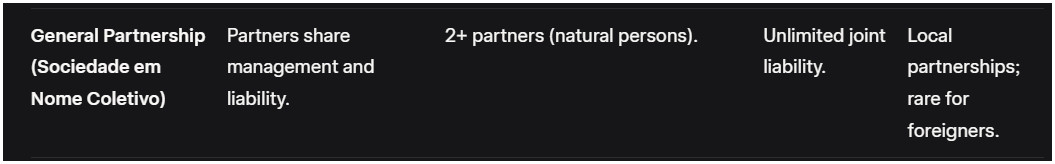

General Partnership (Sociedade em Nome Coletivo)

Simplified Joint Stock Company (Sociedade Anónima Simplificada - SAS): The introduction of the SAS is a major innovation of the 2022 Commercial Code, designed to foster a more dynamic and accessible business environment. This entity offers significant flexibility, particularly for startups and small investors. It is constituted by one or more individuals or legal entities, with limited liability, and can be established with no minimum capital requirement. This structure is seen as a key component of the government's strategy to simplify formal business creation and stimulate innovation. The shares of an SAS are not listed on the stock market, and the subscription and payment of capital are governed by the terms set forth in the share issue document, with a maximum term of three years for payment.

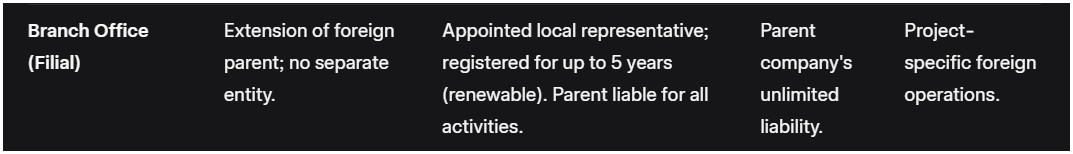

Branch Office (Filial)

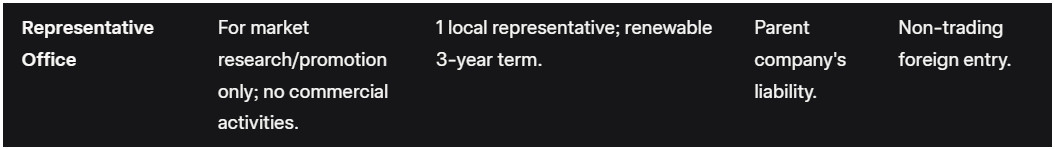

Branch and Representative Office: For foreign entities seeking a presence in Mozambique without full incorporation, a Branch or Representative Office can be established. A Branch is an extension of the overseas parent company and does not have a separate legal identity, meaning the parent company retains full liability. A Representative Office is a non-trading entity, typically used for liaison and marketing activities, which are not subject to corporate tax.

Representative Office

related reading

Official Legal and Regulatory Requirements for Business Registration

Business types and legal structures

Incorporation and Registration

Obtaining a Unique Tax Identification Number NUIT

APIEX Investment and Export Promotion Agency

Confederation of Economic Associations of Mozambique (CTA)

Commercial Registry Offices and E-BAU

Boletim da República (BR): Mozambique's Official Gazette for Public Notices

The Beneficial Ownership Declaration for Foreign Investors in Mozambique