BIM – Banco Internacional de Moçambique

Millennium - bim

BIM – Banco Internacional de Moçambique (Millennium bim): Mozambique's Leading Financial Institution

Banco Internacional de Moçambique, S.A. (BIM), operating under the commercial brand Millennium bim, is one of Mozambique's largest and most influential banks. Founded on October 25, 1995, as a partnership between Banco Comercial Português (now Millennium bcp) and the Mozambican state, BIM has grown into a dominant player in the country's financial sector. Headquartered in Maputo, the bank is renowned for its extensive network, innovative banking services, and significant contributions to Mozambique's economy.

Overview and Strategic Importance

BIM is a systemically important bank in Mozambique, classified by the Bank of Mozambique alongside BCI and Standard Bank. Its operations span retail, corporate, and investment banking, providing a comprehensive suite of financial products to individuals, small and medium enterprises, and large corporate clients. The bank plays a crucial role in financing infrastructure projects, supporting key economic sectors, and driving innovation in digital and sustainable banking services.

Ownership and Structure

-

Major Shareholders:

-

Millennium bcp (via BCP Africa): 66.69%

-

Mozambican State: 17.12%

-

National Institute of Social Security (INSS): 4.95%

-

Mozambican Insurance Company: 4.15%

-

Other minority shareholders: Remaining stakes

-

-

Employees: Approximately 2,500 (recent estimates)

-

Headquarters: Maputo, with central banking services moved to the Jat complex on Rua dos Desportistas in 2014

BIM was formed through the merger of Banco Comercial de Moçambique (BCM) and Banco Internacional de Moçambique, finalized in 2001, creating a unified and robust banking entity.

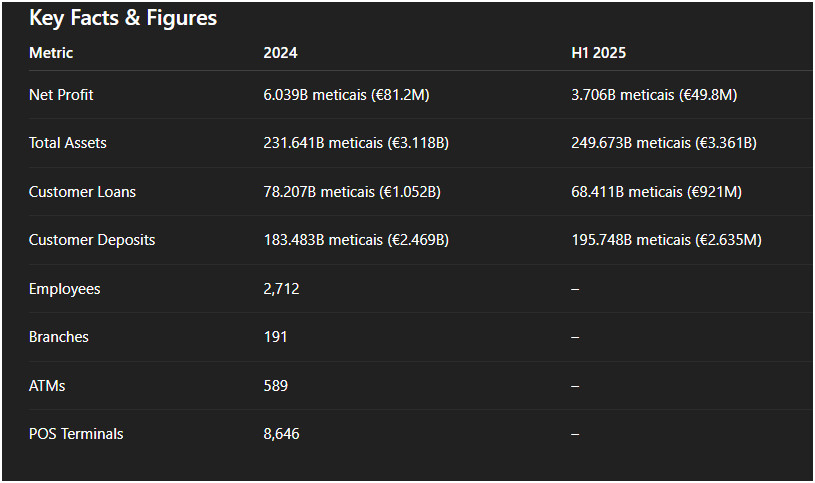

Financial Performance

Profits:

-

2023: 7.2 billion meticais (€102.9 million), an 8.2% increase from 2022

-

2024: Net profit dropped to 3.3 billion meticais (€47.1 million) due to extraordinary impairment costs for public debt

-

H1 2025: 1.6 billion meticais (€23.7 million), reflecting a 50% decrease from H2 2024

Assets and Liabilities:

-

Total Assets: 201.9 billion meticais (€2.718 billion) in 2024, rising to 206 billion meticais (€2.773 billion) by June 2025

-

Liabilities: 167 billion meticais (€2.247 billion) in 2024, increasing to 170 billion meticais (€2.289 billion) by mid-2025

Capital and Solvency:

-

Capital: 34 billion meticais (€457.8 million) in 2024, increasing to 36 billion meticais (€484.9 million) by June 2025

-

Solvency Ratio: 36.7% in 2024, well above the regulatory minimum of 12%

Despite fluctuations in profits, BIM maintains strong liquidity and capital ratios, reflecting robust financial health.

Network and Operational Reach

BIM has the largest branch network in Mozambique, with:

-

Over 160 branches, including mass-market, prestige, and corporate branches

-

More than 600 ATMs and 20,000 POS terminals

-

Over 1.8 million customers as of 2018, reflecting broad market penetration

The bank has been a pioneer in introducing ATMs, POS transactions, debit and credit cards, and a variety of financial products, including:

-

Savings accounts, term deposits, and current accounts

-

Home loans, leasing, and factoring

-

Insurance and bancassurance services

Market Position and Recognition

-

Market Share (2024): Approx. 31.5% of total banking assets in Mozambique

-

Awards: Named Mozambican Bank of the Year 11 times by The Banker, and awarded Best Bank in Mozambique by Euromoney Awards for Excellence 2025

-

Economic Contribution: Largest fiscal contributor to the Mozambican financial system, supporting government revenue and economic development

BIM is considered a key partner for both public and private sectors, financing major infrastructure and development projects across Mozambique.

Strategic Initiatives and Recent Developments

-

Digital Transformation: BIM is heavily investing in digital banking to meet evolving customer needs and improve operational efficiency

-

Sustainability: The bank increasingly focuses on environmental, social, and governance (ESG) factors, aligning lending and operations with international sustainability goals

-

Resilience: Despite economic headwinds, including profit drops in 2024–2025, BIM continues to maintain solvency and stability while supporting growth across the country