Banco Comercial de Investimentos

BCI

Banco Comercial e de Investimentos, SA (BCI): A Pillar of Mozambique's Banking Sector

Banco Comercial e de Investimentos, SA (BCI) is one of Mozambique's leading commercial banks, playing a central role in the country's financial sector. Founded in 1996 (originally as AJM-Banco de Investimentos and rebranded in June 1996), BCI has become a cornerstone institution, serving both individual and corporate clients across Mozambique through an extensive branch and digital network.

Ownership and Structure

BCI is part of the Portuguese Caixa Geral de Depósitos (CGD) group, with its shareholder structure as follows:

-

Caixa Participações (CGD group): 51%

-

BPI (Portuguese bank): 35.67%

-

CGD (direct stake): 10.51%

-

Other Mozambican investors: remaining minority stakes

-

Share Capital: 10 billion meticais (~€138 million)

-

Employees: 2,712 (as of end 2024)

Headquartered in Maputo, BCI operates an extensive network of branches, ATMs, and point-of-sale terminals nationwide.

Financial Performance

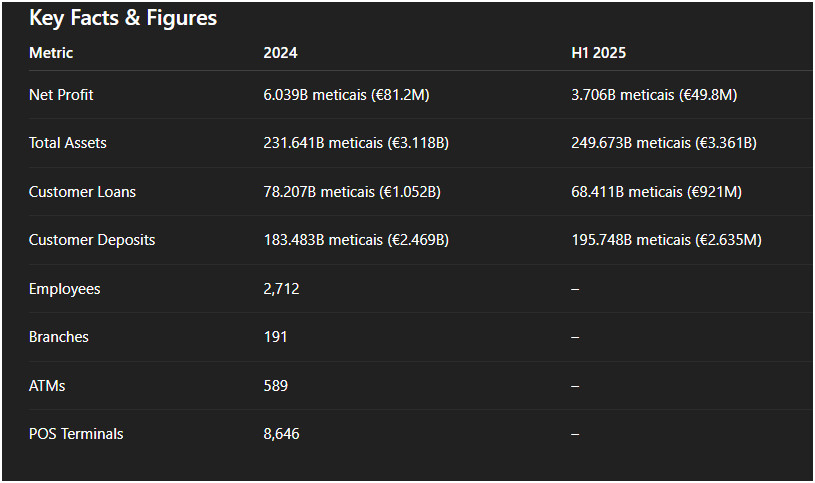

Profits and Growth

-

2023: Record profit of 8.181 billion meticais (€110 million)

-

2024: Profit declined 26.18% to 6.039 billion meticais (€81.2 million) due to increased impairments and provisions amid post-election economic uncertainty.

-

H1 2025: Profits rebounded 4.4% to 3.706 billion meticais (€49.8 million), signaling resilience and recovery.

Assets, Loans, and Deposits

-

Total Assets (2024): 231.641 billion meticais (€3.118 billion)

-

H1 2025: 249.673 billion meticais (€3.361 billion)

-

Customer Loans (H1 2025): 68.411 billion meticais (€921 million)

-

Customer Deposits (H1 2025): 195.748 billion meticais (€2.635 million)

Operational Metrics

-

Branches: 191

-

ATMs: 589

-

POS Terminals: 8,646

-

Credit Recovery (H1 2025): 350 million meticais (~€4.712 million)

Dividend Policy: No dividends were distributed for 2024 to strengthen the balance sheet amid economic uncertainty, despite healthy capital and liquidity ratios.

Market Position

-

Market Share (as of Dec 2024):

-

Credit: 25.8%

-

Deposits: 25.39%

-

Assets: 22.89%

-

-

BCI is considered a systemic bank by the Bank of Mozambique, alongside Millennium bim and Standard Bank, collectively representing ~70% of the country's banking market.

-

Among the top five banks in Mozambique, BCI continues to play a vital role in the financial ecosystem, supporting both private and public sector growth.

Strategic Focus

BCI emphasizes modernization and technological upgrades, including:

-

Contactless payment technology

-

Enhanced ATM functionalities

-

Digital banking solutions

The bank is committed to supporting key sectors, particularly agribusiness, and actively promotes investment through forums and partnerships with international stakeholders, including Italy.

BCI also focuses on corporate social responsibility, investing in education, health, and environmental initiatives across Mozambique.

Recent Developments

-

Profit Recovery: H1 2025 profits up 4.4%, demonstrating resilience after the 2024 decline.

-

Deposit Growth: Customer deposits increased 15% in 2024, strengthening liquidity.

-

Credit Recovery Efforts: Successfully recovered substantial amounts through agreements and operational improvements.

-

Risk Management: Prudently managing sovereign and post-election risks while maintaining strong capital adequacy.