Business Registration in Mozambique: Commercial Registry Offices and E-BAU

Business Registration in Mozambique: A Guide for Foreign Investors Focusing on Commercial Registry Offices and E-BAU

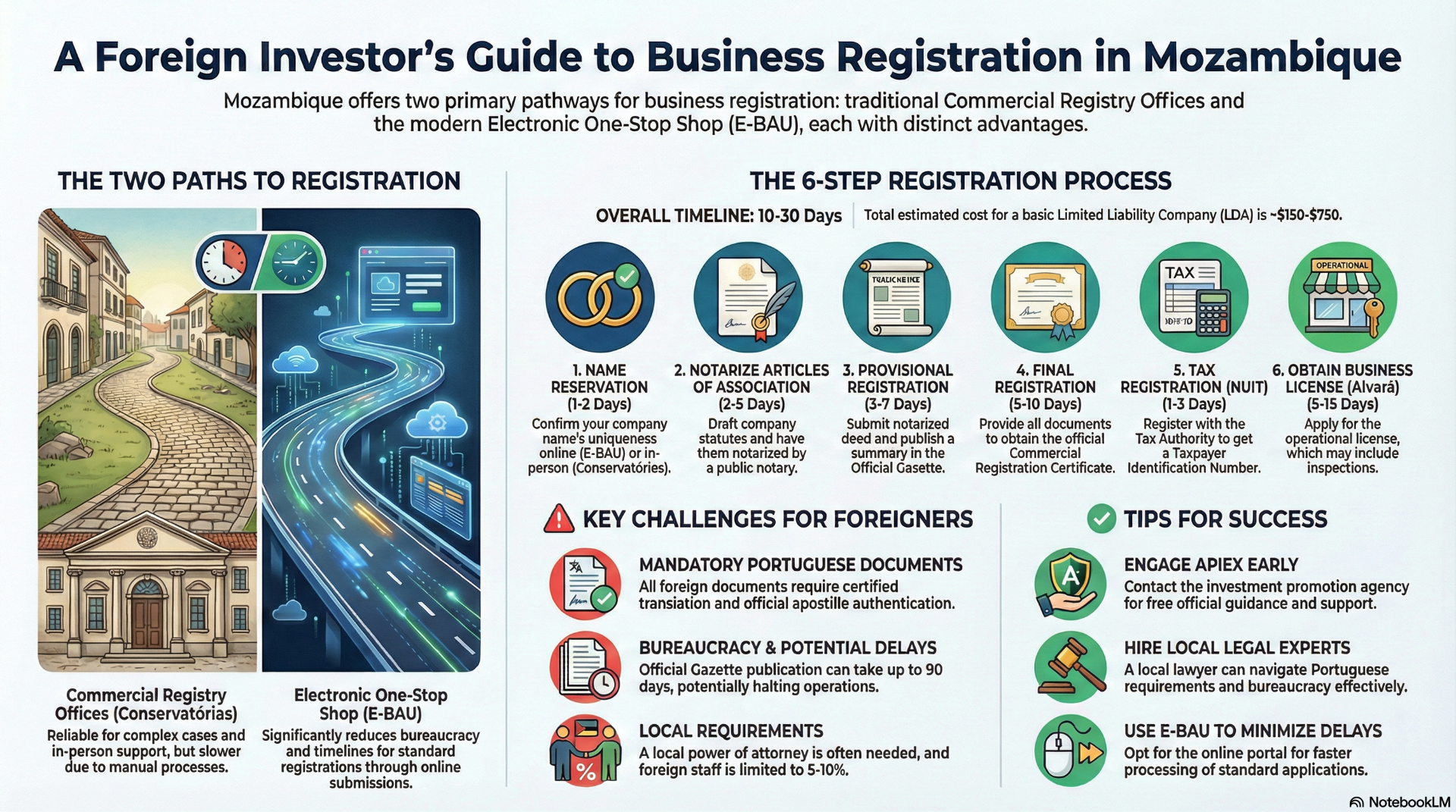

As part of your investment guide to Mozambique, understanding the business registration process is crucial for foreign investors looking to capitalize on the country's growing economy, projected at 2.5% GDP growth in 2025 driven by sectors like services, industry, and natural resources. The registration process is streamlined but requires careful navigation of key institutions. This article delves into the two primary entities handling registration: the Commercial Registry Offices (Conservatórias do Registo Comercial) and the Electronic One-Stop Shop (E-BAU). We'll outline their roles, the step-by-step process, and highlight main issues faced by foreigners, drawing on official regulations as of September 2025.

Overview of the Key Entities

Commercial Registry Offices (Conservatórias do Registo Comercial)

These offices, administered by the Ministry of Justice through the Legal Entities Registry (Conservatória do Registo das Pessoas Coletivas - CRPC), serve as the traditional backbone of business registration in Mozambique. They handle core legal formalities, ensuring companies are properly incorporated and compliant with the Commercial Code (Decree-Law No. 1/2022). Responsibilities include name reservations, provisional and final registrations, issuance of certificates, and beneficial ownership disclosures. Foreign investors often interact with these offices for in-person submissions, especially in provinces or for complex cases. While reliable, the process here can be slower due to manual handling, with timelines extending up to 10-15 days for key steps.

Electronic One-Stop Shop (E-BAU)

E-BAU represents Mozambique's push toward digitalization, acting as an online extension of the Balcão de Atendimento Único (BAU) – the physical One-Stop Shop. Managed under the Ministry of Industry and Commerce with support from APIEX (Agency for Promotion of Investments and Exports),

E-BAU allows for electronic submissions of documents, payments, and tracking, significantly reducing bureaucracy. It's ideal for initial steps like name reservations and license applications, potentially cutting overall timelines to 7-15 days. However, not all processes are fully digitized, and physical verification may still be required for certain documents.

Both entities operate under the same legal framework, including the Private Investment Law (Law No. 8/2023), but E-BAU offers greater efficiency for tech-savvy investors, while Conservatórias provide hands-on support for intricate setups.

Step-by-Step Registration Process

The process typically involves 5-7 steps, taking 10-30 days overall, with costs ranging from MZN 10,000-50,000 (~$150-750) for a basic Limited Liability Company (LDA), excluding legal fees. Foreign investors can own 100% of most entities without local partners, except in restricted sectors like mining or defense. Here's how the entities fit in:

- Name Reservation (1-2 days, MZN 500/~$7.50): Submit an application for a "certidão negativa" to confirm uniqueness. This can be done at Conservatórias in-person or via E-BAU online. Legal basis: Commercial Code provisions on company denomination.

- Draft and Notarize Articles of Association (2-5 days, MZN 5,000-10,000/~$75-150): Prepare statutes outlining purpose, capital, shareholders, and management. Notarization occurs at a public notary, with capital deposited in a local bank (e.g., Millennium BIM). While not directly handled by the entities, proof is submitted to Conservatórias or E-BAU for the next steps.

- Provisional Registration and Incorporation (3-7 days, MZN 2,000/~$30): Submit the notarized deed to Conservatórias for provisional entry. Publish a summary in the Boletim da República (Official Gazette). E-BAU supports online publication requests to expedite this.

- Final Registration (5-10 days): Provide full documents to Conservatórias or BAU/E-BAU for definitive registration and obtain the Commercial Registration Certificate. This includes beneficial ownership declaration (ultimate owners >25% stake) under Decree-Law No. 1/2024.

- Tax Registration (NUIT) (1-3 days, Free): Register with the Tax Authority (Autoridade Tributária) for a Taxpayer Identification Number. Often integrated via E-BAU for seamless processing.

- Business License (Alvará) (5-15 days, MZN 3,000-20,000/~$45-300): Apply through BAU/E-BAU or sector ministries (e.g., Industry and Commerce). Includes inspections; simplified for SMEs.

Post-registration includes social security (INSS) enrollment if hiring staff and APIEX submission for FDI incentives like tax holidays.

For branches or representative offices, additional Ministry approvals apply, extending timelines to 30-60 days.

Main Issues for Foreigners Seeking Registration

Foreign investors face unique hurdles despite the welcoming framework allowing full ownership in non-strategic sectors. Here are the primary challenges:

- Document Requirements and Authentication: All documents must be in Portuguese; unofficial English translations won't suffice, necessitating certified translations. Foreign documents (e.g., passports, powers of attorney) require apostille under the Hague Convention. Passports or IDs for shareholders/directors are mandatory, along with proof of address and capital deposit.

- Power of Attorney and Local Representation: Foreigners often need a power of attorney for a Mozambican resident to handle submissions, especially if not physically present. This adds legal fees (MZN 20,000-50,000/~$300-750) and time for notarization.

- Visa and Work Permits: A business visa is required for entry (on-arrival for many nationalities), but work permits must be obtained post-registration via the Ministry of Labor. Labor laws mandate local hiring quotas (max 5-10% foreigners), complicating staffing.

- Bureaucracy and Delays: Provincial processes are slower than in Maputo, with IT failures or lack of inter-agency coordination causing extensions. Publication in the Boletim da República can take up to 90 days, halting operations. For FDI over MZN 2.7 million (~$42,000), pre-registration with APIEX is essential for incentives but adds a layer.

- Costs and Financial Proof: Fees are based on capital (e.g., 2 per thousand up to MZN 5 million), with no enforced minimum capital but practical needs for bank deposits. Foreign exchange controls require Bank of Mozambique registration within 90 days for repatriation.

- Sector-Specific Restrictions: In areas like land (DUAT requires local incorporation for foreigners) or natural resources, special approvals apply, increasing complexity.

Tips for Success and Conclusion

To mitigate issues, engage APIEX early for free guidance and hire local lawyers (e.g., from MDR Advogados) to handle Portuguese requirements and bureaucracy. Opt for E-BAU to minimize delays, and prepare for a conservative 30-day timeline. Monitor updates via official sites like www.apiex.gov.mz.

In summary, while Commercial Registry Offices provide robust legal oversight and E-BAU enhances accessibility, foreigners must prioritize compliance with documentation, visas, and local partnerships to successfully register and thrive in Mozambique's vibrant market. This structured approach can turn potential challenges into strategic advantages for your investment endeavors.

related reading

Official Legal and Regulatory Requirements for Business Registration

Business types and legal structures

Incorporation and Registration

Obtaining a Unique Tax Identification Number NUIT

APIEX Investment and Export Promotion Agency

Confederation of Economic Associations of Mozambique (CTA)

Commercial Registry Offices and E-BAU

Boletim da República (BR): Mozambique's Official Gazette for Public Notices

The Beneficial Ownership Declaration for Foreign Investors in Mozambique